By Anthony Velez

The Department of Defense (DoD) reported a Fund Balance with Treasury (FBWT) of $623.2 billion on its DoD Agency-Wide Balance Sheet, as of September 30, 2021.(1) The FBWT account represents the aggregate amount of funds available at the United States Department of the Treasury (Treasury) for which the DoD is authorized to make expenditures and pay liabilities.(2) Treasury requires that the DoD reconcile its FBWT accounts on a regular and recurring basis to ensure the integrity and accuracy of its internal and Government-wide financial report data.(3) For years, the DoD Office of Inspector General (OIG) has reported that the DoD does not have effective controls for reconciling FBWT, and that the lack of controls increases the risk of a material misstatement to the Agency-Wide financial statements.(4) In order for DoD to implement an effective FBWT reconciliation, it must first fix its decades-old disbursing process, which has plagued its ability to identify and resolve FBWT issues.

The DoD’s Disbursing Problem

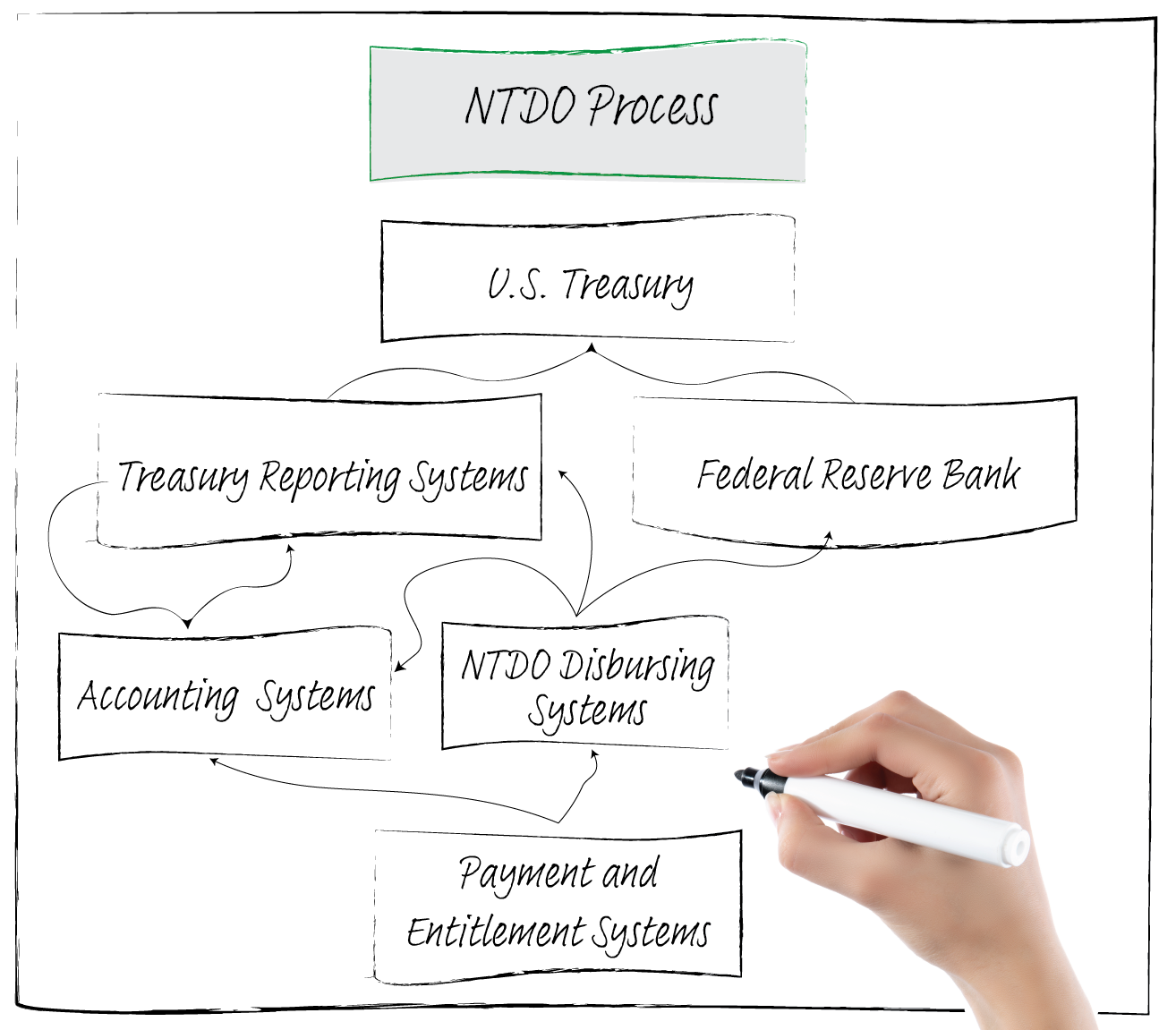

The DoD currently utilizes a combination of Non-Treasury Disbursing Offices (NTDO) and Treasury Disbursing Offices (TDO) to report collection and disbursing activity to Treasury. The legacy NTDO process uses multiple disbursing and reporting systems to process payments and update Treasury accounts. The timing of when the DoD reports the activity through the various systems compared to when the Treasury processes the transactions often differs, contributing to the DoD’s longstanding material weakness over FBWT. The complex NTDO process does not allow all DoD components to reconcile their FBWT accounts directly with Treasury and has resulted in the creation of numerous complex and ineffective reconciliation processes. For example, Treasury Index (TI) 97 Other Defense Organizations (ODO) are unable to reconcile directly to their Treasury balances, as Treasury does not provide reports to break out each agency’s balance. As a result, the DoD must create a manual bank statement, called the Cash Management Report (CMR), to reconcile its ODO agencies’ FBWT activity to Treasury. The DoD OIG and many Independent Public Accountants (IPA) have discovered issues with the accuracy and reliability of the CMR.(5) The NTDO process also creates large monthly differences between Treasury and the disbursing systems, called Statement of Differences, which creates a risk that DoD component FBWT balances are incomplete. In contrast, when the DoD processes payments through its TDOs, many of these reporting and reconciling challenges are resolved.

The Future of DoD Disbursing

TDO payments are initiated using modern Enterprise Resource Planning (ERP) systems and utilize Treasury’s centralized disbursing process to make the payment directly, thereby increasing the accuracy and completeness of the agency’s FBWT and reducing variances related to timing differences. The DoD recognizes the multiple benefits of converting from NTDO to TDO and has begun implementing the changes required to become a full TDO agency. Some of the benefits of the DoD converting fully to TDO include the elimination of FBWT Statement of Differences, reduction of DoD suspense account activity, and the ability of the DoD to perform daily FBWT reconciliations. Treasury’s centralized disbursing process could significantly improve the DoD’s ability to reduce its FBWT material weakness and move toward the path of obtaining an unmodified opinion. Before the DoD can achieve these benefits, it must first overcome the many challenges it faces implementing the new process.

Challenges Moving to Treasury Direct Disbursing

One of the primary challenges DoD faces in converting to Treasury Disbursing is the continued use of legacy accounting and entitlement systems and the intricate processes in place to accommodate the complex DoD financial environment. Over the years, the DoD has identified multiple legacy systems to decommission but has been slow to phase them out and transition to modern ERP systems. Some of the delays have been due to competing priorities, budget constraints, and dependencies with system project management offices. Knowing that converting to TDO would take years to implement, in FY 2020, DoD management required all Components to begin submitting FBWT disbursement and collection transactions to Treasury on a daily basis, whether they use NTDOs or TDOs.(6) All NTDOs are required to submit payment information daily through Treasury’s Payment Information Repository (PIR) until they are fully converted to TDO. However, Tier 1 agencies, such as the United States Air Force (AF) and United States Marine Corps (Marine Corps) are not scheduled to fully implement this policy until October 2028, and the United States Army (Army) and Department of the Navy (DON) are not scheduled to fully implement the policy until December 2030.(7)

Areas to Improve

The DoD has the ability to fix its decades-old disbursing process and resolve the systemic FBWT issues that have contributed to its annual Disclaimer of an opinion. To mitigate some of the systemic challenges in implementing TDO, the DoD should consider prioritizing the conversion. This includes reviewing general ledger (GL) system migration timelines from legacy to ERP and the decommission of legacy disbursing systems. New FBWT reconciliation tools will need to be developed to ensure the iterative process improvements from NTDO to TDO are properly considered. With the right planning and implementation, DoD could accelerate its implementation timeline and move toward obtaining a modified or unmodified opinion.

Connect with Us

This publication is for informational purposes only and does not constitute professional advice or services, or an endorsement of any kind.

Kearney is a Certified Public Accounting (CPA) firm focused on providing accounting and consulting services to the Federal Government. For more information about Kearney, please visit us at www.kearneyco.com or contact us at (703) 931-5600.

(1) Understanding the Results of the Audit of the FY 2021 DoD Financial Statements

https://www.dodig.mil/Portals/48/Documents/Reports/Understanding%20the%20Results%20of%20the%20FY%202021%20Audit_Final.pdf?ver=J5FksKFlPPWNBakBwWO88w%3D%3D

(2) Statement of Federal Financial Accounting Standards 1: Accounting for Selected Assets and Liabilities

https://files.fasab.gov/pdffiles/handbook_sffas_1.pdf

(3) Treasury Financial Manual (TFM) Volume 1, Part 2, Chapter 5100, Section 5120, Background https://tfm.fiscal.treasury.gov/v1/p2/c510.html

(4) DoD Agency Financial Report Fiscal Year 2021 https://comptroller.defense.gov/Portals/45/Documents/afr/fy2021/DoD_FY21_Agency_Financial_Report.pdf

(5) The TI 97 CMR

https://media.defense.gov/2018/Jun/07/2001928452/-1/-1/1/DODIG-2018-120.PDF

(6) Understanding the Results of the Audit of the FY 2021 DoD Financial Statements

https://www.dodig.mil/Portals/48/Documents/Reports/Understanding%20the%20Results%20of%20the%20FY%202021%20Audit_Final.pdf?ver=J5FksKFlPPWNBakBwWO88w%3D%3D

(7) Understanding the Results of the Audit of the FY 2021 DoD Financial Statements

https://www.dodig.mil/Portals/48/Documents/Reports/Understanding%20the%20Results%20of%20the%20FY%202021%20Audit_Final.pdf?ver=J5FksKFlPPWNBakBwWO88w%3D%3D